Conflicted attachment to money; how to actually save money after you lost it all to gambling…

A little while back during one of my group sessions for homeless problem gamblers, we were discussing what sort of things one should prioritise when money is at hand.

I asked the group to list their 3 priorities that their money should be used for.

Some very strange results were gathered.

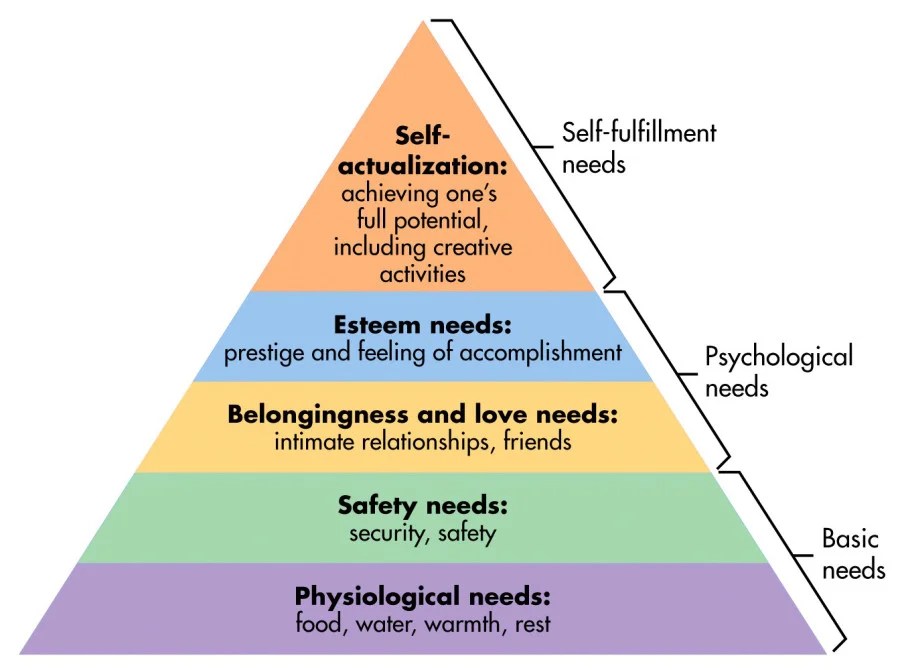

Not completely surprisingly, for some it was their addictions that was their first priority. They were aware of this not being a great way to prioritise, and part of the purpose for the exercise was of course to figure out how to better prioritise money in order to make it more difficult to spend money on gambling, alcohol, drugs etc. What I did not expect to see however, was the word SAVINGS appearing again and again within the first few priorities listed for individuals who are still rough sleeping, barely eating and gambling. At first it struck me as strange. Granted I never really was a ‘saver’ myself so noticing my own bias, I still found it curious that one would even consider a relative luxury such as saving money when you cannot even begin to make ends meet. I felt compelled to explore this further with them. We brought out the Maslow’s hierarchy of needs – see image below and discussed where ‘savings’ would fit. As it turned out; savings represented something very important for this particular group of gamblers. Having all come from shattered backgrounds , dominated by unpredictability, lack of security both in terms of housing and relationships; savings had become a disproportionately important concept. It had come to represent security and safety, which is a very basic need. Unfortunately, as we established, prioritising savings over and above real and necessary basic needs is not a great solution even without an addiction, and with one- it is a disaster since the savings end up going towards the addiction anyway!

Money can mean different things to different people, and the idea that money equals security is of course not an uncommon notion.

For example; amongst the gamblers I see, many report having had situations when they were kids that scared them – for example a parent’s business going into liquidation and the family needing to move suddenly, an addicted parent or a situation where needs were going unmet due to poverty. Again; perfectly valid reasons for money to be seen as a source of safety and security.

Having reflected a bit on this attachment to money, and as I have understood it- particularly the attachment to the idea of accumulating money, has helped me understand better why so many gamblers I meet with would dispel my repeated nagging about using their money well. My recommendations of spending it all on priorities such as food vouchers, travel cards etc ( in order to remove opportunity to gamble it away) and no wonder this has been met with resistance when really all they were craving for was to see a little bit of money finally build up in their bank account.

The problem is - it never DOES build up! As long as the gambling is going strong- accessible savings for a gambler are about as likely to remain in the bank, as a stash of unused needles are for a heroin addict!

Unless the savings are done with real care and contemplation.

So this is why I wrote this blog post- to help you take some useful steps in enabling you too to start building up a capital – even at times that are very rough financially due to repayment plans, debts owed , penalty fees and not to mention dire emotional shame and grief over the money that has been lost entirely and will never come back.

Coming back to the powerful attachment that many gamblers have with money (and that is without even touching on the attachment to the process of gambling itself which is typically even more important); If you are a person who has tried to stop gambling, or perhaps been successful in stopping already ; you might be noticing that there are those aspects of recovery pertaining to money, that often feels worse in the immediate period of time after your last bets. This is despite knowing that giving up gambling is undoubtedly the right course of action for you.

Why your money situation sometimes feel worse after quitting gambling…

#No more chance of ‘winning it all back’

Whilst still gambling, there is a good chance your thoughts of money had a strong flare of fantasy. Constantly betting on the potential of winning, and frequently fantasising about what to do when that win indeed comes in.

Maybe it was going to be used to recuperate the debts you ran up?

Pay people back?

Or to take that holiday you wanted to take that you could never afford?

Maybe the money is going to help you start building your life again after the gambling had ruined it?

When the gambling is discontinued – first and foremost, please feel reassured that you HAVE taken the right step!! You probably know this in your heart. The trouble is that the mind does not always follow – and might instead be firing away with tricky urge-inducing thoughts trying to compel you to go back to the gambling

‘now you don’t have any opportunity to win… how are you then going to get out of this hole’

‘look at what I ‘invested’ – I should have awaited the payback that would surely have come…now I will never know’

‘my gosh if I am going to need to work to pay all those people back – I will never get there…’

‘if I just try one more time then I might be at least get a bit closer to pay this debt off and then I absolutely will stop’

Those same very delusional thoughts that got you here to begin with. Make sure that you don’t buy into them, tempting as they are at this desperate time.

#Potential money is not the same as actual money in your hand. Those are two different things.

Not saying this to sound patronising- it is said to help you tell truth apart from fantasy, when chances are that the two have been confused in the past. The trouble is that it can be hard to let go of that fantasy. In spite of the overwhelming evidence showing you that you actually never end up a winner (since you continue gambling whether or not you loose or win) those moments of hope and anticipation can still induce powerful emotional memories that are tough to leave behind.

# Allowing shame of debts you have incurred to disallow you from pursuing safe accumulation of money by telling yourself you need to focus on repaying people/institutions; when what actually ends up happening is that you waste the money on more gambling in an attempt to win back losses.

That was a long sentence highlighting a potentially controversial idea. Namely to begin the building up your own finances before even completing your repayment plans. This may induce guilt, shame, anger in others and a range of other difficult feelings and reactions. I would of course advocate that you consider the moral standpoint of this decision thoroughly, but whilst doing so also consider this: Are you guilty of thinking you are going to pay money back to people and later that month actually end up wasting that same money on gambling? If so, then this idea for saving small amounts may still be for you. Without the stress and pressure of waiting to see if you win. Without chasing. And without sitting in hidden shame and desperation wondering how you are going to tell people around you that the money you had promised did not actually appear in the end. You will at least have something to show for it long term.

So finally, here are some ideas for starting to build up a small capital, which in turn can at least prevent you from feeling that you are years away from starting to get back on your feet, and also give you some useful practice in managing any larger amounts of money that may be coming in longer term.

# Prioritise your savings contribution

I started using this methodology a little while back myself actually, very much after having the following reflection; If I have never saved up until this point, and can’t seem to save now- what makes me think I ever will feel able to? Sometimes when we wait for things to ‘feel right’ we can wait a very long time. A bit like having babies- many people wait for so long that they can no longer conceive for the feeling to kick in. Sometimes just going ahead with a behaviour (within reason obviously) is the way to go. With that in mind I decided to start putting away a very small amount every week instead- small enough for it to hardly be noticeable but large enough to prevent me from using that money on useless things that will bring no value longer term. I have never had a gambling problem and these days I don’t have any large debts except my student loans. Morally and legally, you obviously need to prioritise your repayments to others before paying into a savings; however try and consider prioritising your savings as a second priority by using only very small amounts that you can afford to be without. With the impact of ‘compounding’ from interests, even small amounts such as £1-2 per day can really grow over time. Regardless of what you think, you probably have this amount of money available or else you would not have been able to gamble. This can be a hugely boosting and offer that sense of stability, recovery and growth that many of my gamblers are yearning for, but use gambling to reach for instead.

The one I have tried is called Moneybox which is an ISA that also comes with an app that you can program to either do ‘round ups’ or alternatively you can chose which amount you would like to contribute to your saving every week. Moneybox will collect the money from your account once per week and will invest it according to one of 3 levels of risk that you have opted for. If you want to get away from taking risk, go for the lower risk option. A nice feature is that you can follow your money’s growth from the app and therefore watch it grow. It takes over two weeks to get the money out which helps too since that sort of time would be far longer than most gamblers could wait to complete a chase for a win! An added benefit is that people who are a bit impulsive and/or enjoy the taking of some risk, can enjoy the ups and downs of the market fluctuations – yet not in any way be involved in any way whatsoever in the placing of the money. There are a few other apps that are similar, so worth having a look around for one whose terms and conditions and investment strategies matches your needs. If you prefer a more traditional cash ISA solution, many of my clients have found good ones through the post office. The app is however a fairly fun feature that appeals to gamblers’ love for instant gratification and reward, in that the money are locked away yet clearly visible so that the sight of the rising amounts can be enjoyed often.

# Stop thinking for the day only in terms of your financial planning ;

Gambling is an activity that keeps you in a short-term state of mind; which in turn makes this type of thinking potentially feel very different and novel. Planning and calculating can be very difficult and boring for anyone who is suffering with ‘emotional and practical short-sightedness’. If you want to get anywhere with your money, it makes perfect sense and can even be inspirational to sit down and calculate how much you are actually putting towards unnecessary items; be it gambling or other pointless expenses. You may also wish to do a forecast of how much that money could be worth if you allowed it to benefit from the compounding effect derived from having ongoing interest compounding on each other. How much will you have in 2 years? What about in 5? Or 10? It is guaranteed to be more than you think! If you realise that there is a significant chunk of money still getting spilled every month- how about practicing locking that away into an account where it cannot be reached instead? see post below for more info on locking money away.

# Own up to your reality

If every month you tell yourself that you will save, but every month those savings end up going towards gambling (or indirectly towards gambling by first spending your money on gambling and you therefore are needing to dip into the allocated saving to afford necessities) then it is high time to face to the reality of what happens. You are not able to save using your current formula and need to adjust your method!

# Whatever you do - lock the money away!

One of the classic traps is to be overly optimistic about one’s self-discipline. You don’t need to be a problem gambler to have high hopes in your good moments for how likely you are to allow the money to sit in the bank account when times then get tough. This point ties directly in to the first one about prioritising your saving contribution- if money is not available to us, we will simply have to make do with what we have. If on the other hand it is available to us, we are quite likely to create a need for something that otherwise we would not have needed. If you have ever been to say TK MAXX you will need what I mean by creating needs that weren’t there before. For a gambler, the ‘need’ can easily end up being gambling, but can just as well be something else. Once the money has been put away securely without direct access it can actually feel somewhat relieving to know that you will be unable to pursue your addiction- this is something gamblers have been telling me for many years. Let’s not forget that money constitutes the biggest gambling trigger! If there is no money, often time the cravings will actually stop in their track to start with. Some of my more entrenched homeless problem gamblers have not infrequently been able to sustain themselves perfectly well during times when no money is coming in and have also reported experiencing less cravings. In the worst of situations I have even seen gamblers opt out of benefit payments etc to prevent a feeling of the money ‘burning a hole in the pocket’. This is a great shame when there are practical solutions to assist with keeping money away from you these days. Do explore the variety of ISA’s, pensions or whatever is applicable and if you have the luxury of someone else in your life that you can trust, you could even allow them to help you set it up and act as a person who also controls the account together with yourself in order to minimize risks of future unwarranted withdrawals.

In hope that some of you can be helped by this method and that you will find it encouraging to yet again see something, even if it is an ever so small amount, build up reliably in a place that is safe and sound from your gambling problems.

Good luck, Annika X