Gambler’s questions: Why do I end up going back to gambling when I am finally about to become debt-free?

Predictable triggers

Recovery from gambling addiction offers no shortage of triggering situations. Many of those can be pre-emptively explored, avoided or dealt with appropriately. For example, you would probably not want to line yourself up for your good friend’s stag in Vegas or weekends with friends at the races if indeed your gambling has been known to happen in such venues.

Equally, if you are an online gambler, being home alone with plenty of time, zero external accountabilities and some money to hand is going to be a very bad concoction of triggers.

Knowing your triggers does not always equate to protecting oneself from them, but at least you would have had a chance to pinpoint what the risk factors would be and try to take action to protect yourself.

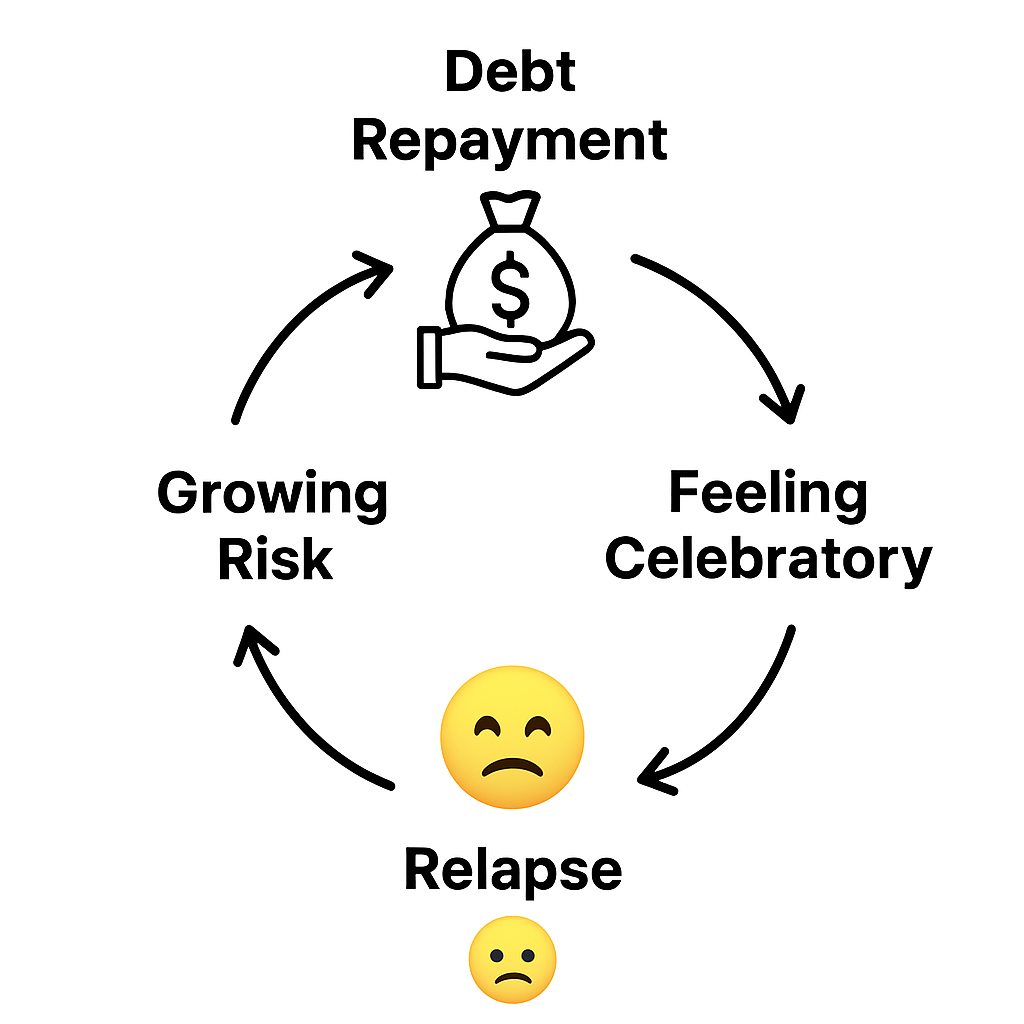

A less obvious trigger: the end of your repayments

One of the less obvious types of triggers is the type that arises from positive and excited feelings. For example, feeling as though you have finally mastered recovery or repaid a big chunk of debt. It could also be the joy of getting something difficult done, such as a hard conversation or taking a step towards progress you previously thought of as impossible. These are the type of steps you want to and should be taking. Yet, these positive feelings can at times start shifting you from a state of solid and stable recovery, to suddenly getting overwhelmed by triggering thoughts, fantasies of winning and all the great stuff you recognise you will soon be able to do. The anticipation of soon having the money is not far-fetched for gamblers, whose entire lifestyle often is one of living in hope for money that may soon be won.

This mood state is something I often refer to as ‘celebratory’ as I feel like it describes well what is going on in these moments. It is a bit more buzz to the feeling than just ‘good’, and there is a definite sprinkle of reward added to it. It is essentially a dopamine surge. And this is precisely what makes it a bit risky in the context of gambling. It can very quickly flood you with positive memories of prior gambling wins and magically erase the many losses and negative consequences. It is as if you have put on filtering glasses that see only good, and any sense of realism is temporarily disabled. Before you know it, you have permitted yourself to bet again.

Think about the following scenario:

After months, if not years, of dutifully repaying the debts that were incurred through gambling, you are finally beginning to see the light at the end of the tunnel. But as the date approaches and the anticipation runs high, the thoughts of gambling start worming their way back into your thought patterns.

‘I am so near now; how cool would it be if I placed a small bet, won and then was able to pay back the last of my debts’ or ‘I have been doing so well with all these repayments, it would barely make a dent. Let me just make a small bet. I have better control now’.

It is not that surprising that anticipation and excitement run high as the big date of being debt-free approaches. In many ways, the emotions you feel might mimic the fantasy of a win you used to have when you were still at large gambling. You feel good, empowered and a bit ‘rich’. Suddenly, a small detour back to gambling would no longer be so terrible, you think to yourself.

None of these experiences is surprising. They entail everything your gambling was made of. A rollercoaster from sad, angry to anticipating, ‘achieved’ and all the rest of it. Gamblers in this state often struggle to listen to the advice against protecting themselves financially and adding barriers to their cards/cash. Much like a bipolar client stops taking their meds when they feel manic, gamblers stop engaging with financial barriers when they are doing better, and the money is growing in the account. (and that is not to say that gamblers have bipolar disorder- just to be clear on that).

‘I am almost paid off now, finally I can let me guard down’ goes the thinking towards the end of the repyment plan- and instead of ensuring that the money with absolute certainty ends up where it needs to, this instead becomes a time for sloppier boundaries, a bit of leeway suddenly provided regarding the managing of funds.

A bit like deciding to stop for a bite to eat before the last 3 km of a marathon, many gamblers decide (but not necessarily with their best reasoning in charge) that they can afford a little roll of the dice at this special time. And so they return to another round of betting which sets them back weeks, months and sometimes even years. Drug addicts or alcoholics will face similar risks and tendencies of relapse, but often not with quite the enduring long-term consequences (unless one drink/drug taking opportunity leads to many to come). For gamblers, a weekend spree of gambling can set someone back several months, if not years, if the amounts are big enough.

The case of Mary - the moment of excited dwelling that led to a lapse

One of my clients who had diligently been paying off her gambling debts for the last 3 years, had been getting thrilled about the end of her repayment plan. Just ahead of her final repayment, she had been home alone one evening and making happy calculations on her laptop, getting herself excited about how her change would now start changing for the better.

She had googled everything from local spa deals to holiday homes abroad. Aaah, the stuff she would be able to enjoy soon. She simply could not wait!

The dopamine was literally flooding her brain. Just the thought of it all brought on a little familiar head rush. This is where her recall of ‘what happened next’ comes to a stop. Next thing she knew, she had been spending several hours on a poker site playing both poker and other games.

The losses were quite significant and when she started to ‘come down’ from the high, she realised she had set herself back nearly an entire year again. She had taken out a payday loan after an initial win and a loss and had subsequently lost the entire loan too.

Naturally, she was devastated. She felt perplexed and could not believe that this had actually happened. She felt stupid, humiliated and concerned about her loss of control. Although it took some time to get over the shock about what had happened and the felt need to ‘chase back’ what had been lost, this became a turning point for Mary.

It made her realise that she would never really be without vulnerability and that all the safeguarding measures that we had been talking so much about needed to remain in place for the long term. She was finally willing to accept that she had no control over the way her addiction presented. By recognising this, she could control her proximity and access to large amounts of money to the point where a situation like this would not be able to occur. She is still gambling free despite having been up against a couple of really strong triggering moments since.

So does this mean I should prevent myself from feeling good? It seems like a catch-22 where I cannot feel too low or too good…what am I supposed to do?

This is a true dilemma which many gamblers in therapy present with, and it is understandable that it feels counterintuitive to have to accept that feeling good and nearing one’s goal could become a major trigger for a relapse. You are working so hard on moving yourself forward and feeling good, and then those very feelings you have been longing to experience end up becoming a slippery slope right back to the gambling.

This is genuinely disappointing and naturally makes you wonder what the point of recovery really is. So let me comfort you a bit. These good feelings are indeed part of what you are working to achieve. You very much deserve to feel celebratory, and you also deserve a reward for the hard work you are doing. But despite getting better and moving forward in your recovery, you absolutely need to accept that even in those great states of mind, you can be just as vulnerable as in the low ones. In fact, ANY strong emotional state will make you more susceptible to impulsive action, and you will therefore need to take precautions on a very practical level.

So, while that may sound super depressing, it actually comes back to the very basics of recovery work.

When you accept that your addiction MEANS you no longer operate from a place of conscious control over your behaviour, you will be every so much more realistic in terms of the safeguarding measures you apply.

I have had numerous therapy session ‘debates’ with the gamblers I treat, where I keep saying

‘ What exact negatives are there with protecting yourself from spending your money in unintentional ways’

Statements such as ‘feeling less in control’ to ‘but I should not have to do this’ tend to come up. Many people also feel like it would be humiliating to be a person with financial boundaries in place, to which I always point out that this humiliation still fades in comparison to the one experienced post a lapse.

I may not have struggled with gambling personally, but I can definitely relate to some of the issues around telling myself one thing and doing another when it comes to finances. I have in the past often fallen prey to mindless or emotionally driven purchasing. Could be that expensive lunch that I felt I ‘deserved’ despite having gone through the hassle of packing one, or just spending for the hell of it on a day when I feel like I need a pick me up.

Guess how I put a stop to all of that? Yep. By practising what I preach. Financial barriers, keeping only what I actually need in my account and locking any extras up either by paying bills upfront or just putting them into locked boxes where I am unable to withdraw impulsively. I don’t see this as a defeat. It is realism! If it needs to be like that to protect myself from doing something ‘of the moment’ that does not serve me well, so be it. It is really important not to look at these interventions as something only gamblers have or as something that signifies that you are somehow flawed. You are a human, and to an extent we all struggle with similar stuff although they of course can present on a spectrum of severity.

I know that the urge to gamble far overrides my urge to spend in those moments described. And I truly know that addictions are many levels up in terms of the loss of control and inner conflict experienced.

Therefore, all the more reason to adhere to this simple but hard-to-accept formula:

No money × No opportunity = No gambling ***THIS ONE IS THE ONE TO IMPLEMENT*****

Money × Opportunity = High likelihood of gambling

Money × No opportunity = Delayed gambling (risk still active)

Returning to gambling as a form of self-sabotage or fear of future responsibilities

The case of ‘Jimmy’

Jimmy who had been sleeping rough for the better part of 5 years, used to bring in anecdotes about how he could sleep through literally anything. Having slept inside and outside of Victoria station in London, several weeks around various parts of Heathrow airport and also had a stint where he circulated on London’s night buses, he was no stranger to sleeping with noise. He was gambling constantly and spent every penny that entered his pocket on slot machines.

One day, he was called in to the housing association of his local council and was told he would be housed. He would finally get a small flat! Jimmy was so thrilled that he shed a tear that session. He could not believe it. This was going to be the beginning of something new and stable. He would be able to build his life up again, and the gambling would stop. No more gambling ‘to survive’. Well, 3 weeks in- Jimmy attended a session, letting me know he was back on the street.

‘The neighbour’s washing machine was driving me mad- When I complained to the council, they wouldn’t do anything about it. I figured there was no difference than just staying out if I wasn’t even going to get a peaceful night’s sleep anyway ‘

The group members were shocked at first. How could he have done this to himself? After all those years of waiting, he was now dismissing the only route towards stability. When we looked under the hood of this behaviour, you could kind of understand how he had come to this conclusion although it was not precisely helpful for him in the longer term.

He argued: When I was on the street, my life felt like the devil I knew. You get treated badly and you know you are going to have a rough time. There are people around you all the time in the same boat and you just get used living like that with constant uncertainty. There is always something happening… But when I was suddenly sitting there in my flat all I heard was silence. Me, my thoughts, my feelings and just this major dread of responsibility. How was I going to be able to put my name to an energy contract? How can I ensure there is money when that bill comes in? It was just too much. I couldn’t cope and gave the flat back again.’

This may seem an extreme situation, but it illustrates some important points.

When good things are near, there is often an increased sense of fear. Here are some of the feelings that often surface when you near a point you have been trying to reach for a while:

Fear of having something to lose again.

Fear of responsibility; practical and emotional

Anxiety about change, uncertainty and what comes next

fear about one’s own capabilities of coping

While I will not be going through the exact ways in which these can be addressed, for now, I will say this:

Do not let these fears delude your thinking and affect your decision-making. Growth will ALWAYS involve the confronting of fears, anxiety and dealing with learning how to manage uncertainty. I promise you that the uncertainty and risks you will face as a non-gambling individual are far more lenient on the system than those you will be facing if you indeed return to gambling. Fear and anxiety can be managed, and you can learn positive and helpful coping tools..

So long as you ensure you put a complete block on your avenues to gamble, you will have little other choice than to cope through those tough moments. And although they are very tough early days, you will quickly start recognising that you can do it. If there are skills gaps, which there likely will be, make it your goal to fill them with actual coping skills.

Takeaway points:

Nearing a point where you are getting out of debt or actually going somewhere in your recovery can lead to a mixed bag of emotions. People are often a bit more prepared for the lapses that originate from a negative state of mind but people are often taken by shock and surprise about the lapses that happen when things are finally improving and good feelings are creeping back up. The sense of defeat can also feel greater and more crushing since it creates conflicted feelings about whether it is actually worth the hassle to continue in recovery. (To make sure you don’t get confused - it is always worth continuing in recovery! )

Sadly, both good and bad feelings can trigger a lapse! And to ensure that good times remain good, you will have to consider the types of challenges that come with growth, responsibility and also the very desirable feelings of achievement that will come with being in recovery.

Since it is impossible to foresee every single emotional shift you will experience as a human being, you need instead to remain focused on overcoming any reluctance to put safeguarding measures in place.

That way, you can release some of the need to control how you will feel at any given moment and instead give yourself freedom and flexibility to go through those novel feelings peacefully and without rush.

‘If there is a will, there is a way’ say all gamblers about their desire to return to gambling. And with that comes the distorted conclusion of not putting any barriers in place. The reasoning tends to center around the need to ‘conquer’ recovery without having to have those restrictions in place. If you think about it, there is no added value to achieving that. It is not a competition or something you need to ‘win’. You are trying to put rationality over emotion and prevent yourself from falling into the many pitfalls that recovery from addiction has on offer.

I am pretty sure you are using the same part of your brain to figure out suitable barriers as you are figuring out ways to overcome them. Yet when you ask gamblers to generate obstacles to fulfilling their gambling urges, I often notice an eery silence. This is not the result of stupidity or ignorance but simply due to the inner conflict experienced and is nothing to be ashamed of. It is, however, something to be very well aware of! A part of you wants to continue and one part wants to stop. Let the good part win and put those barriers in place asap so that your upward trajectory does not have to equate to an increased risk of lapsing.

Wishing you all the best for your recovery journey!

With love,

Annika